Business Funding Made Easy

Your Source for Ready Capital When the Banks Say NO!

Invoice Factoring

Finance your important terms of payment with your valuable customers. The perfect solution for payroll worries when customers take 15 to 75 days to pay their invoices

Inventory Finance

Revolving lines of credit to finance accounts receivable, inventory, and equipment. The solution of choice for rapidly growing manufacturers and distributors

Merchant Cash Advance

How retail-based entrepreneurs can finance operations, purchases of equipment, and expand facilities and more with revenue-based advances on future sales.

Our Services

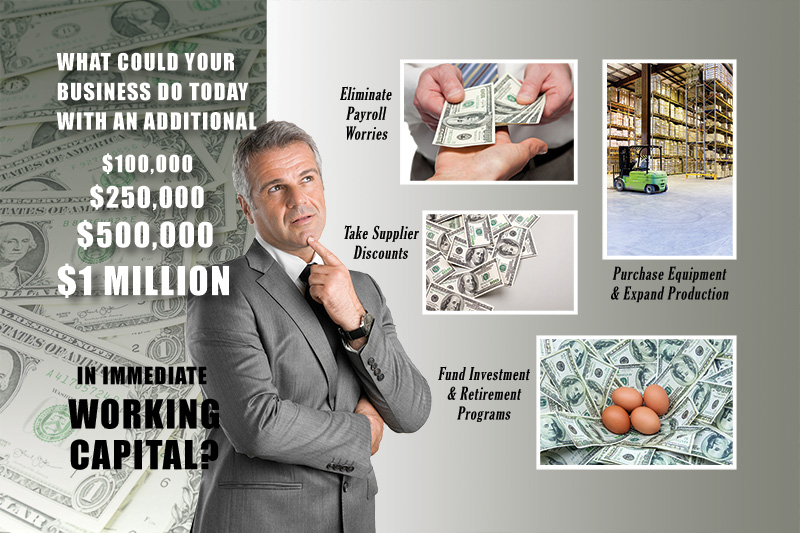

What Could You Do With....

- $100,000

- $250,000

- $500,000

- $1 Million Dollars

With Immediate Working Capital

We Provide You With....

- Accounts Receivable Factoring

- ABL and SBA Revolving Lines of Credit

- Merchant Cash Advance

- Equipment Leasing and Finance

Recent Articles

One of the most common questions asked by small business owners when exploring their financing options is whether factoring or merchant cash advance is the best …

Reverse Factoring is a method of alternative commercial finance where the supplying party (client) has it’s receivables finance by an early payment …

he factoring of construction related receivables is certainly one of the more difficult niche areas of factoring from the transactional standpoint, but …

The SBA Microloan Program can be of special interest to many of our clients and especially with assisting small start-ups. Under this …